The revenue cycle – the series of steps related to reimbursement for services that occur from intake to payment – is the lifeblood of any homecare or I/DD agency. You can provide the best client support with excellent outcomes and grow like a weed, but with the thin margins we experience today, your agency will struggle if you don’t collect almost 100% of the revenue to which you are entitled.

For agency leadership, there’s a natural inclination to focus attention on the revenue cycle if they believe performance is a problem. The question then becomes, does that leave enough management capacity to focus on providing excellent client support, growing the agency, and executing on the challenges and opportunities that exist in today’s market?

Below is an illustration of the current market. When you consider the items in the chart, what we might consider to be challenges could, in fact, be turned into opportunities with proper focus and execution. Agencies whose management is purely reactive and not strategic will miss these opportunities. Focusing too much management time on the revenue cycle could put your agency in that position.

There are the challenges, risks, and costs (let’s appropriately call these headaches) associated with managing any internal process. With respect to Revenue Cycle, these include:

- Performance: Every percent collected under 100% of revenue is a significant cost

- Productivity/Staffing: Time off, weather, turnover, timing of staff additions to cover growth, and bad hires

- Cost: Staff cost is more than just base pay – add overtime, employer payroll taxes, workers’ compensation and other insurances, employee benefits (health insurance, retirement plans, etc.), payroll services costs (timekeeping, calculation, banking, tax prep), human resources administration, temporary replacement personnel

- Turnover – internal and external recruitment, background checks and drug testing, initial training, lost productivity, cost of bad hire that needs to be repeated

- Overhead – rent, supplies, utilities, ongoing training and education, technology costs

- Expertise: Keeping up with payer changes, new payers, government mandates, and establishing payer relationships for claims assistance

- Technology: EDI, ERA, EFT maximization to generate efficiencies, improve cash flow, and meet payer requirements

- Analysis and reporting: KPIs, metrics, identification of issues and root causes

- Focus: Consistent application of management attention, as well as follow-up with the correct functional areas to address root cause issues both inside and outside the revenue cycle departments

Outsourcing revenue cycle functions may enable agencies to maximize revenue and cash flow performance while providing them with the capacity to focus on delivering excellent support, growing their agency, addressing strategic opportunities, and doing so while remaining as profitable as possible.

The decision to outsource must consider balancing the natural concerns with the potential benefits. Balance is achieved by managing both.

What Do I Need to Know First?

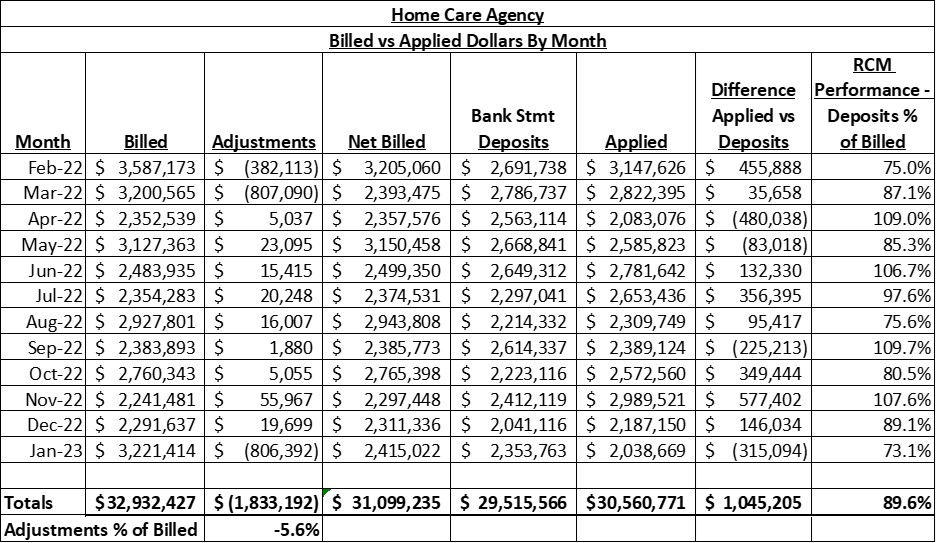

The first step in this evaluation is to obtain an understanding of current collections performance. How am I doing? This is a surprisingly simple exercise, performed by comparing receipts to revenue for a year. The analysis can be enhanced by also comparing how many of those receipts were actually posted to the AR, which gives a view into the accuracy of your AR reports. This analysis should be easy and likely can be done by a junior-level accounting resource.

Evaluating the revenue billed vs. cash deposits vs. payments applied over the course of a year smooths out any month-to-month anomalies and gives insights into true performance. In the case of the agency in the above illustration, we can identify the following issues:

- RCM performance reflects that they only collected 89.6% of their billing, a 10.4% shortfall. With thinning margins in home care, this could be catastrophic.

- Adjustments are 5.6% of billing, notably high. And there are some months with large adjustments. Are these to correct prior years? What is the root cause of these high amounts?

- Difference between payments applied and total deposits—month-to-month and for the year as a whole—there should be a discipline to applying all payments received within a set time frame—48 hours optimally. This provides accurate receivables, and allows for timely identification and addressing of issues.

The natural next step is to “drill down” to see where and why it’s occurring. What we also don’t know from the analysis is if the revenue was billed at the correct rates. If they over-billed, then the percentage collected is understated. If they under-billed, they may be missing a revenue opportunity on top of the payment shortfall. This might indicate the first benefit opportunity of outsourcing – to determine the underlying issues and recommend remediation solutions. With all the above being researched and understood, the next step is to determine the cost-benefit of addressing it internally or by outsourcing all or components of the process. That balance of management resources that we previously discussed must be considered. Is the agency better off having management focus on the external opportunities vs. internal process remediation and results monitoring?

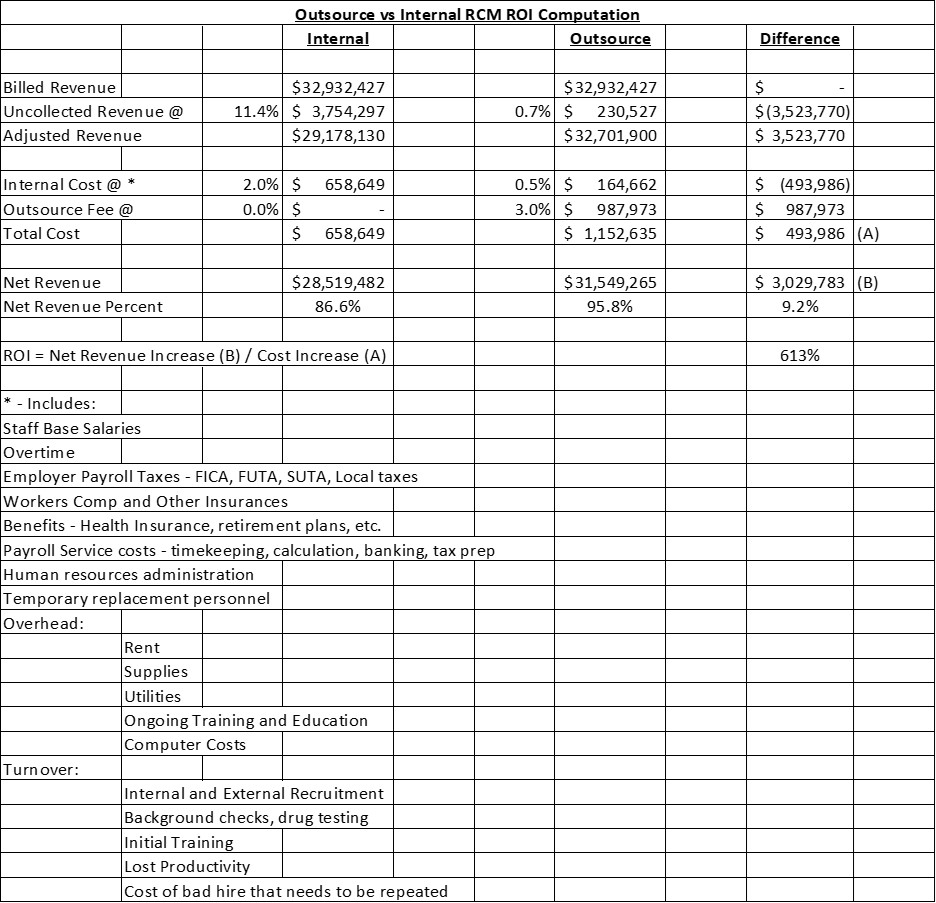

Notwithstanding the “softer” side of the analysis, here is a simple financial analysis of outsourcing the entire revenue cycle process for the agency in the above illustration:

Full–Service Revenue Cycle Management Cost-Benefit Analysis / ROI

The ROI computation consists of the incremental net revenue performance divided by the net increase in cost. While the expended cost of outsourcing might be higher than insourcing, which at face value makes outsourcing look more expensive, the revenue cycle performance improvement (reduction in uncollected revenue) far outweighs the expended cost in this example. What is not considered here is the added benefits to agency growth and operational efficiencies and effectiveness (including client care) generated by allowing agency management to focus on those aspects of the business. And billed revenue might also be benefited by ensuring that correct rates are used.

Also, the analysis begs the question, “Why is there still an internal cost if I’m outsourcing my entire revenue cycle process?” There still needs to be some agency infrastructure left in place to support the process. These include processing authorizations, updating contracts, bringing issues to external departments, and supporting the outsourced vendor by providing documentation, remittance information, and answers to questions on client services. There is also agency management oversight required – reviewing reports and monitoring progress and performance. It should be far less than for an internal revenue cycle department, but outsourcing is delegation, not abdication.

Sandata’s Revenue Management Solution is a service whose mission is to maximize revenue cycle performance and, thereby, agency revenue and cash flow. We provide revenue cycle management outsourcing, as well as revenue cycle effectiveness evaluation, regardless of agency management solution. Schedule a call with our experts to start your evaluation today.